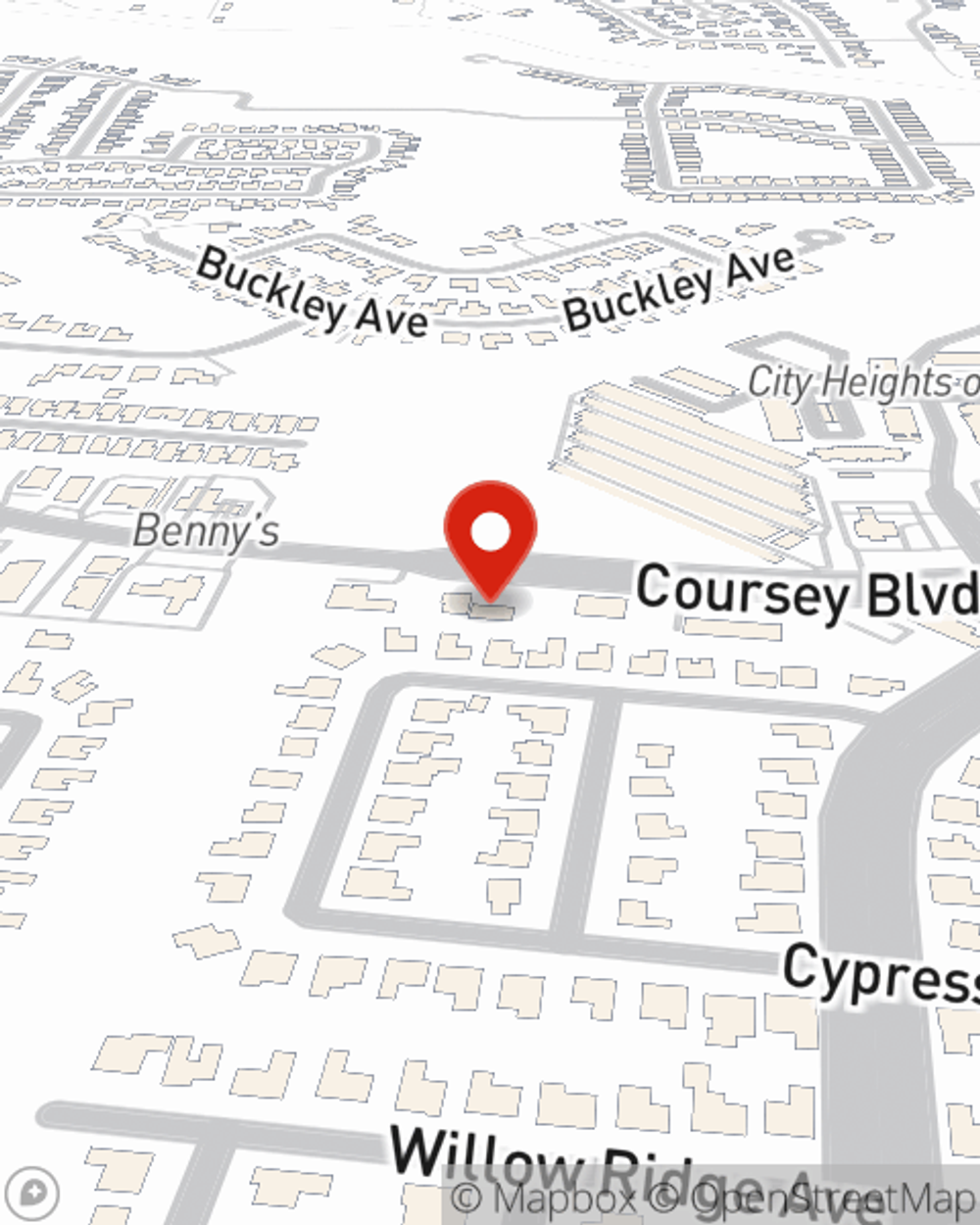

Business Insurance in and around Baton Rouge

Calling all small business owners of Baton Rouge!

This small business insurance is not risky

- Louisiana

- Baton Rouge

- St. George

- East Baton Rouge

- Livingston

- Central

- Denham Springs

- Zachary

- Walker

- Shenandoah

- Oneal Lane

- Coursey

- Stumberg

Help Protect Your Business With State Farm.

Small business owners like you wear a lot of hats. From social media manager to customer service rep, you do whatever is needed each day to make your business a success. Are you a drywall installer, an electrician or a physician? Do you own an art gallery, a shoe repair shop or a beauty salon? Whatever you do, State Farm may have small business insurance to cover it.

Calling all small business owners of Baton Rouge!

This small business insurance is not risky

Strictly Business With State Farm

Your business thrives off your creativity commitment, and having dependable coverage with State Farm. While you do what you love and lead your employees, let State Farm do their part in supporting you with business owners policies, worker’s compensation and commercial auto policies.

Since 1935, State Farm has helped small businesses manage risk. Call or email agent Steve Johnson's team to discover the options specifically available to you!

Simple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Steve Johnson

State Farm® Insurance AgentSimple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.